China’s TOPCon Module Prices Jump 30%+ Since Mid-December — What It Means for Your 2026 Solar Plans

Posted by Nastech on 30th Jan 2026

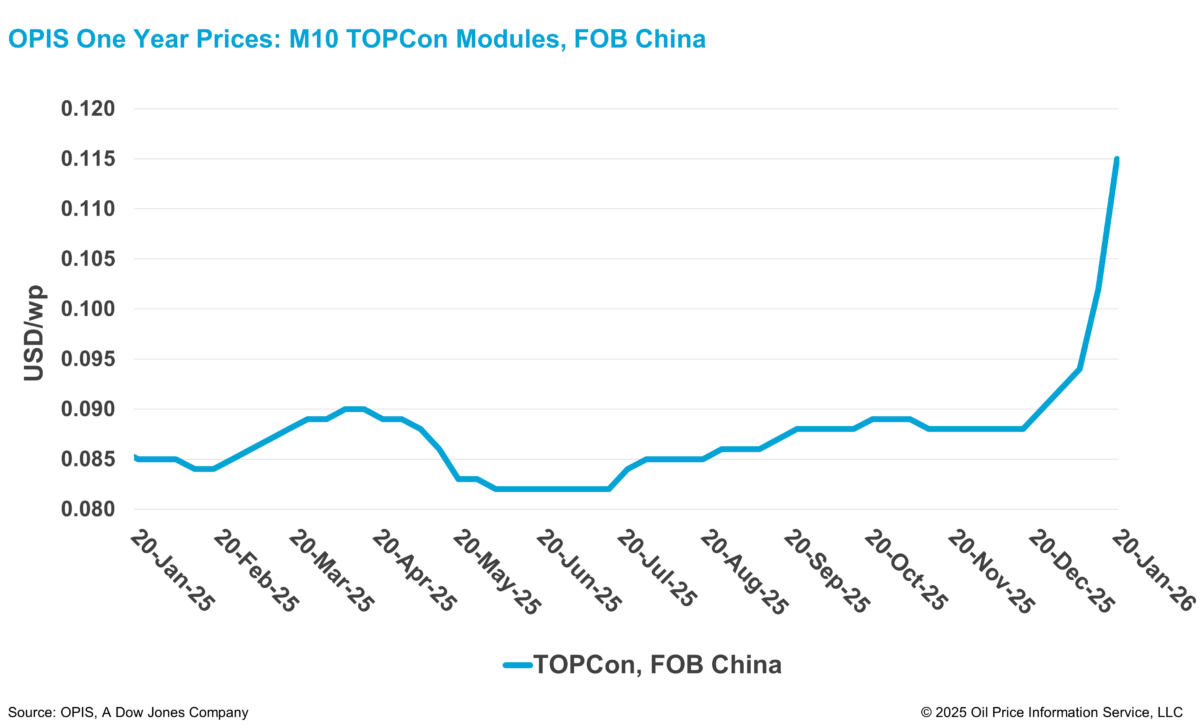

Module prices aren’t supposed to move this fast at the start of the year—yet here we are. According to a new weekly market update, China-made TOPCon module prices have climbed more than 30% since mid-December, marking the third straight week of gains. The move is tied to policy shifts and upstream cost pressure, and it’s already filtering into forward pricing.

What changed (and why it happened)

-

Policy shock → rush to ship: Chinese manufacturers are running hard ahead of an export-tax/rebate change, which has tightened near-term supply and firmed offers. Market participants are still digesting the policy impact, keeping bids elevated.

- Forward curve ticks up too: It’s not just spot. Forward prices have edged higher, signaling expectations that policy and costs will keep modules firmer into upcoming delivery windows.

- Input costs rising: Separate coverage this week highlights silver hitting record levels, adding acute pressure on cell metallization costs—one of the biggest variable inputs at the moment

How this can affect buyers outside China

-

FOB → DDP pass-through: Even if you buy delivered (DDP), tighter FOB China pricing tends to pass through with a lag—especially for near-term deliveries. Expect firmer quotes for Q1–Q2 2026 if your supplier is exposed to Chinese TOPCon capacity

- Lead-time risk: When factories prioritize certain lanes or product bins, lead times can stretch. Locking specs (watt class, frame, junction box) early reduces re-quote risk. (Inference based on observed pass-through dynamics from the cited market update.)

- Volatility not done: Additional analysis this week suggests module prices could hover around ~$0.12/W later in 2026, but getting there may involve more swings—policy plus costs aren’t settled.

Practical moves for EPCs, installers, and asset owners

1) Time-box your RFQs and hold terms.

Short-expiry quotes, indexed to a trusted benchmark, help you avoid surprise uplifts between award and PO. (This aligns with the trend of rising spot and forward assessments.)

2) Split procurement: near-term vs. back-half.

If you must build in Q1–Q2, consider securing part of your volume now and leaving optionality for H2 if the market stabilizes. Recent reporting points to a ~$0.12/W equilibrium later, but not with high confidence yet.

3) Validate BoM flexibility.

Agree in advance on acceptable alternative watt classes/bins to keep projects moving without full re-engineering if a specific model tightens. (A common mitigation when spot tightens.)

4) Watch the silver channel.

Silver’s all-time high adds risk to cell paste costs, and any further spikes could pressure cell/module quotes again. Track weekly metals notes alongside PV offers.

Guidance by project type

-

Utility-scale: Consider forward hedges or framework agreements with indexed adjustments; model upside/downside bands around interconnection and COD milestones to protect IRR if modules firm further.

- Commercial & industrial (C&I): Lock critical rooftop windows (crane, shutdowns) and pair with flexible module specs to avoid scheduling penalties if a preferred SKU tightens. (Best practice given the current spot/forward dynamics.)

- Residential portfolios: Standardize on 1–2 compatible watt classes and pre-approve substitutions so branch offices can place POs quickly when stock is available. (Process advice informed by current market tightness.)

What to tell customers right now

-

“This isn’t a promo cycle—this is policy + cost.” Price firmness is showing up in spot and forwards; transparency builds trust when you explain the drivers

- “Schedule matters.” The earlier you finalize site readiness and permits, the easier it is to secure modules at acceptable terms during tight windows. (Generalized from the observed market tightening.)

- “We’ll protect the BoM.” Emphasize compatible alternatives so performance guarantees and aesthetics remain intact even if you switch SKUs.

-

Bottom line

The headline is simple: TOPCon module prices out of China are up 30%+ since mid-December, and forward quotes have nudged higher too. Build some price and lead-time resilience into your next orders, keep a close eye on metals like silver, and structure procurement to survive a bumpy first half.

Source: pv magazine, “China TOPCon solar module prices climb over 30% since mid-December,” Jan 23, 2026.